Despite a raft of positive economic data from retail sales to improved 3rd quarter GDP. Political infighting flared between the incoming Trump administration and the Democrats after they tried to pass a bloated spending bill. Using the standard last-minute tactics led to a showdown over the pork and censorship filled bill. That has since spilled over into a threatened government shutdown starting tonight. Markets spooked by the political infighting went sharply lower as the week progressed. Finishing with notable losses. The DOW gave up 973 points or 2.22%, the NASDAQ slipped 319 points or 1.6% While the S&P 500 lost 119 points or 1.97%. This despite another ¼% cut to interest rates as expected.

Economic Data Stays Strong

Generally exceeding expectations this week despite the political infighting. The BEA’s final estimate of Q3 GDP was revised up to 3.1% on strength in final sales, consumer spending and net exports. GDP growth estimates for the 4th quarter were also revised up to 3.1% per the Atlanta Fed’s GDPNow model. 2025 GDP should come in between 2.5 and 3.5% though there is considerable uncertainty with that range given Trumps proposed trade and economic policies.

Retail sales beat expectations for a 6th consecutive month in November, up .7%, and 3.8% from a year ago. As a result of improved auto sales and better than expected Christmas shopping data. The previous month was revised up as well. Big spending and a wobbly labor market do not typically go hand-in-hand, nor do recessions. Solid economic data like this will give the Fed pause with respect to additional rate cuts.

About Those Rate Cuts

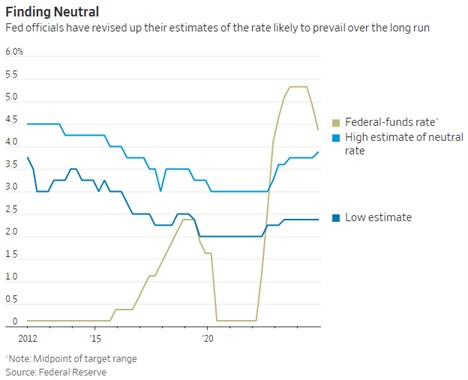

The markets through a hissy fit mid-week. After Fed Chairman Powell failed to provide. The aggressive rate cutting noises the market was expecting for 2025. As a result of doubts regarding the current effective neutral rate. This question is front and center now. Because the Fed has cut rates by a full percentage point, or 100 basis points. While the economy appears to be in reasonably good shape. Leading central bankers to become more cautious about making additional cuts. While the neutral rate remains elusive. To quote Chairman Powell, “We don’t know exactly where it is, but … what we know for sure is that we’re a hundred basis points closer to it right now.” Thanks to the Federal Reserve for the chart.

While the neutral rate remains uncertain. The inverted yield curve has all but disappeared. As the Treasury Yield Table below illustrates.

What About Next Year?

Some key considerations include:

- A mix of mid-single-digit revenue growth and margin expansion should lead to double-digit EPS growth in 2025 and 2026 for the S&P 500.

- Assuming rates get cut a few times next year against a healthy EPS growth backdrop. It’s doubtful that market multiples will compress much. The latest estimates forecast only a modest decline in the forward P/E to 21.5x.

The cadence of earnings growth offers an insightful perspective on where we are in the business cycle.

If the inflection in growth currently on display is off the zero bound. Given the absence of an unemployment cycle, it represents an extension of the current cycle (i.e., a soft landing and subsequent growth acceleration). It’s also worth pointing out that this late cycle extension given the tightness in the labor market. Are typically driven by some feature unique to that particular cycle. In this case robust consumer spending and strong wage growth. Thanks to FactSet for the chart

This will be my final installment until after the New Year. Thank you all for stopping by this year. I hope the markets treated you well in 2024. Wishing you all the very best in 2025.

Caleb

Last Week’s Post: Inflation Next Year?

Follow me on Social Media

FaceBook: Caleb Lawrence RIA Inc Facebook

LinkedIn: Caleb Lawrence | LinkedIn