37% of the S&P 500 companies have reported 3rd quarter earnings, 75% have beaten earnings estimates to date. The 5.7% average beat rate, however, is lackluster by historical standards. In contrast, this represents the 5th consecutive quarter of rising earnings. At the sector level meanwhile, IT, Communications and Health Care are reporting the strongest 3rd quarter earnings growth on a year ago basis. Similarly, 59% of companies are beating revenue estimates to date. A little on the soft side but the reporting season is still very young. Looking at the future shows’ earnings growth expectations for Q-4 2024 of 13.4%; same for Q-1 2025, 12.6% for Q-2 2025; and 9.3% for all of 2024. Thanks to FactSet for the chart.

For The Week

The S&P 500 lost 57 points or 1%, the NASDAQ gained 29 points or .2%, the DOW plunged 1,162 points or 2.7%. Not a good week for the Blue-Chips following mixed trading.

Interest Rates Are Up?

Since the Fed’s surprise ½% rate cut back in September. The 10-Year Treasury yield has risen steadily breaching the 4.2% level for the first time since July. Leaving many a pundit embarrassed by their lower rates for mortgages and loans calls. On the other hand, it is not unheard of for rates to rise, immediately following a Fed rate cut. As the chart from TradingView shows.

Furthermore, the failure of traditional monetary tools, interest rates, money supply, liquidity etc., in the modern era to effectively manage the economy and inflation. Has cast a real shadow over the effectiveness of old school macro indicators. Considering the excessive debt of the USA and other western countries, then higher interest rates are a non-starter as a result. Implying that new tools are needed. Consequently, tariffs have entered the discussion, despite being considered a dirty word in many an economic and policy circle.

With the Trump Trade growing larger as the election draws near. PredicIt has the odds of him winning at 58%, others higher. The discussion surrounding tariffs has returned, as a result. Some of the more interesting points made include having large trade deficits gives us significant leverage over our trading partners. Allowing us to bring factories and employment back to the US as a result. Through the application of tariffs, consequently shifting domestic tax burdens offshore.

Interest Payments Top Defense Spending

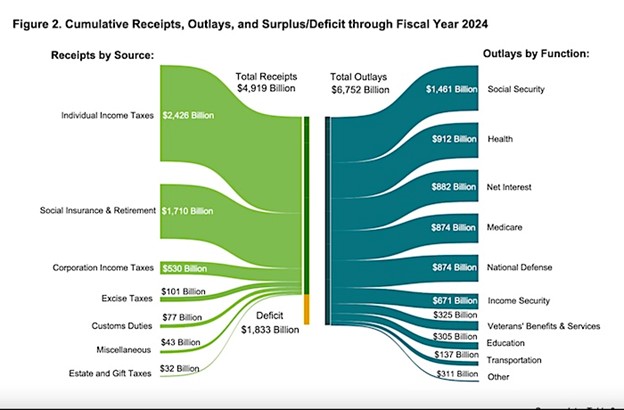

The Treasury Department reports that the Federal Deficit topped 1.8 trillion in Fiscal 2024, which ended in September. The 3rd highest annual deficit recorded behind the panic spending seen during the Covid years. As the chart illustrates.

Rising debt plus higher interest rates is an expensive combination, as a result interest payments jumped 35% to 882 billion last fiscal year. The first time in history that debt service costs have exceed defense spending. In conclusion, simply looking at the chart above tells us something has to give.

That’s all for this week folks, I’ll see you again next Friday.

Best, Caleb

Last Week’s Post: Solid Numbers

Follow me on Social Media

FaceBook: Caleb Lawrence RIA Inc Facebook

LinkedIn: Caleb Lawrence | LinkedIn